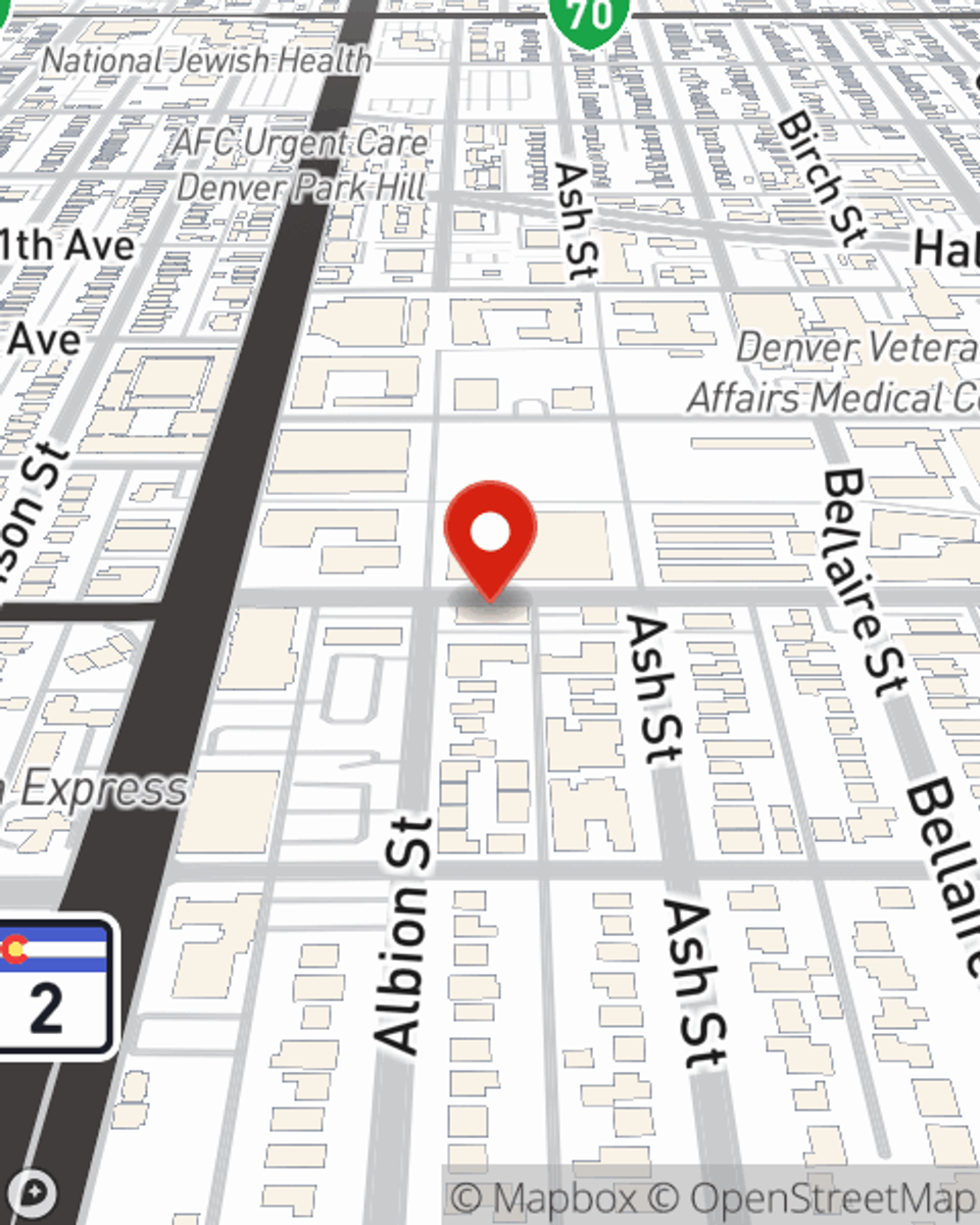

Life Insurance in and around Denver

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Denver

- Greenwood Village

- Centennial

- Lone Tree

- Englewood

- Aurora

- Littleton

- Lakewood

- Parker

- Green Valley

- Arvada

- Wheatridge

- Boulder

- Superior

- Louisville

- Northglenn

- Thornton

- Glendale

- Highlands Ranch

- Colorado Springs

- Fort Collins

- Commerce City

- Westminster

Check Out Life Insurance Options With State Farm

The normal cost of funerals nowadays is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the people you love to pay for your burial or cremation as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help your loved ones afford funeral arrangements and not end up with large debts.

Get insured for what matters to you

What are you waiting for?

Their Future Is Safe With State Farm

You’ll get that and more with State Farm life insurance. State Farm has terrific policy choices to keep those you love safe with a policy that’s personalized to accommodate your specific needs. Fortunately you won’t have to figure that out by yourself. With solid values and terrific customer service, State Farm Agent Joe Adams walks you through every step to provide you with coverage that protects your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Joe Adams's office today to explore how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Joe at (303) 388-4949 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.